Institutional client offerings and solutions

Providing institutional clients access to sales and trading expertise in global equities, fixed income and futures, extensive capital markets services, and robust multi-asset clearing and custody solutions.

We connect clients to markets

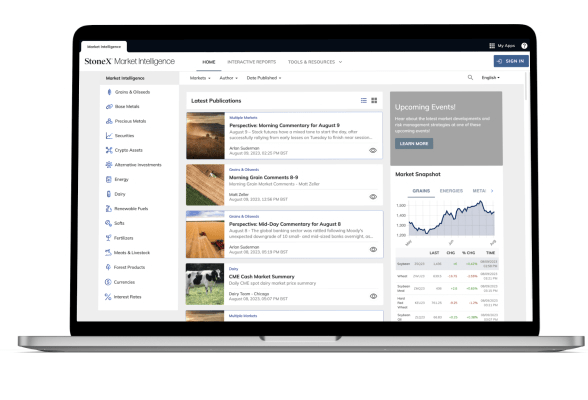

At StoneX, we provide our institutional clients with access to information, sophisticated products and efficient markets.

It’s important to know the people you’re trading with, and the values they stand for. At StoneX, we believe that transparency, education and clear communication create lasting relationships with our clients.

Our institutional clients

We provide global access, unparalleled insight and advanced expertise to help our institutional clients meet their financial goals.

- Asset managers

- Broker-dealers

- Commercial bank trusts

- Family offices

- Financial institutions

- Fund managers

- Hedge funds

- Insurance companies

- Introducing broker dealers

- Money managers

- Pension funds

- Professional traders

- Wealth managers

Our prime brokerage offering

StoneX Prime provides hedge funds, family offices, mutual funds and other investment managers with a full self-clearing prime offering combined with introduced prime solutions.

Securities lending

Custody solutions

Repo and outsourced trading

Debt Capital Markets

We provide a full range of services to clients of all sizes looking to raise capital through private credit, bond issuances, and other creative financing solutions.

Our FX trading and liquidity offering

We offer deep market access, advanced technology, customized FX solutions, and high-touch service to our clients.

Pairing experience with expertise to position our clients for success

In 2021, StoneX worked with The GEO Group Inc. to underwrite a $230 million convertible bond new issue for the Boca Raton-based, publicly traded REIT. This engagement demonstrated the full breadth of our team’s experience, our industry contacts, and our ability to distribute across our own client base – leveraging the capabilities and reach of our StoneX High Yield and Distressed teams in addition to our own.

Solutions

StoneX offers a wide variety of customized financial services to help you meet your strategic objectives.

Upcoming events

Let’s get connected

To learn more about how our customized financial solutions can help you stay one step ahead in the global markets, contact our team today.

Select your location

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to securities trading and prime services are made on behalf of the BD Division of SFI. References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. You can learn more about the background of StoneX Financial Inc. on BrokerCheck.

StoneX Outsourced Services LLC provides Outsourced Trading Services. The company is a member of FINRA/SIPC and NFA , and registered with the SEC as a Broker Dealer and CFTC. You can learn more about the background of StoneX Outsourced Services LLC on BrokerCheck.

Wealth management services are offered through StoneX Wealth Management, a trade name used by StoneX Securities Inc., member FINRA/SIPC and StoneX Advisors Inc. StoneX Securities Inc. and StoneX Advisors Inc. are wholly owned subsidiaries of StoneX Group Inc. You can learn more about the background of StoneX Securities Inc. on BrokerCheck.

StoneX One is a proprietary online trading platform through which investors and traders can open securities and/or futures accounts. Accounts opened through StoneX One are currently available to U.S. persons only. Not all products are available. StoneX One accounts opened through StoneX Securities Inc. are introduced to and custodied at StoneX Financial Inc. (SFI), and all customer orders will be transmitted to SFI for execution, clearance and settlement.

Securities products offered by StoneX Financial Inc. (“SFI”) & StoneX Outsourced Services LLC are intended only for an audience of institutional clients only. Securities products offered by StoneX Securities Inc. and investment advisory services offered by StoneX Advisors Inc. are intended for an audience of retail clients only.

This information is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX Group Inc. of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you.

Additional disclosures can be found on https://stonex.com/compliance-library/

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.